VioletaStoimenova

With a market capitalization of $1.29 billion, Enterprise Financial Services Corp (NASDAQ:EFSC) is not exactly a large bank. But it’s not a small one, either. In recent years, management has succeeded in growing the bank at a rather nice clip. Growing assets has been instrumental in pushing up revenue and profits over the past few years. Relative to earnings and book value, shares of the bank are attractive and deposit growth is appealing. While not everything about the institution is perfect, it does look interesting enough to warrant a “buy” rating at this time.

A solid opportunity right now

According to the management team at Enterprise Financial Services, the company operates as a financial holding firm that is based out of Missouri. Like all other banks out there, it provides a wide array of services. It accepts deposits from customers and lends those deposits out in the form of loans. Examples include, but are not limited to, commercial and industrial loans, loans dedicated for the purchase of commercial real estate, real estate construction loans, residential real estate loans, and more. But the firm does more than just this. The company also has a wealth management arm that provides services to individuals and corporate customers and it has some other miscellaneous operations as well.

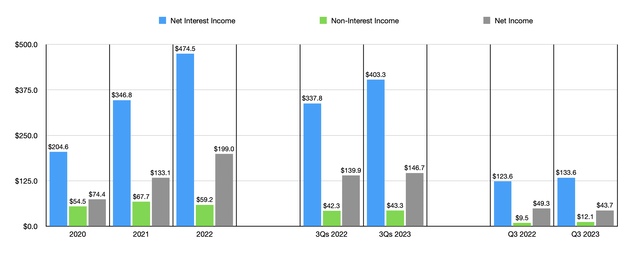

Author – SEC EDGAR Data

Over the past few years, management has done a pretty good job of growing the enterprise. Net interest income, for instance, jumped from $204.6 million in 2020 to $474.5 million in 2022. Non-interest income has remained in a fairly narrow range during this window of time. But that has not stopped net profits from climbing from $74.4 million to $199 million. So far this year, the general trend has been positive. Non-interest income inched up from $42.3 million last year to $43.3 million this year. But the real winner has been net interest income. It popped from $337.8 million to $403.3 million. And this has helped net profits to grow from $139.3 million to $146.7 million.

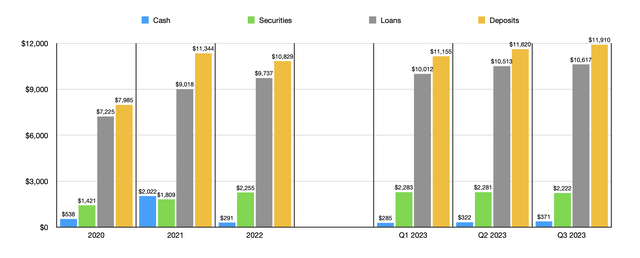

Author – SEC EDGAR Data

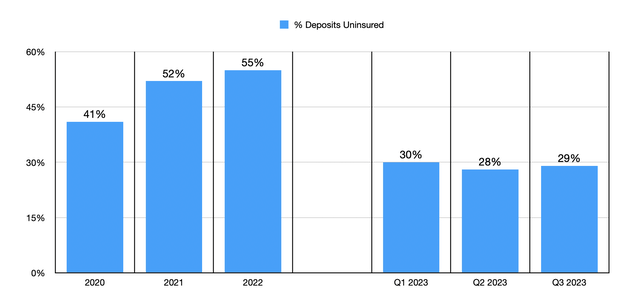

This growth over time has only been made possible by a growth in assets. And a growth in assets has only been made possible by growing deposits. Deposits spiked from $7.99 billion in 2020 to $11.34 billion in 2021. They did then fall to $10.83 billion in 2022. But since then, the bank has seen a rebound on this front. By the third quarter of 2023, deposits had grown to $11.91 billion. This growth occurred even as management made a concerted effort to reduce exposure to uninsured deposits. Those managed to fall from 55% of total deposits at the end of last year to 29% as of the end of the most recent quarter. This is just below the 30% threshold that I tend to like as a maximum. So that’s great to see.

Author – SEC EDGAR Data

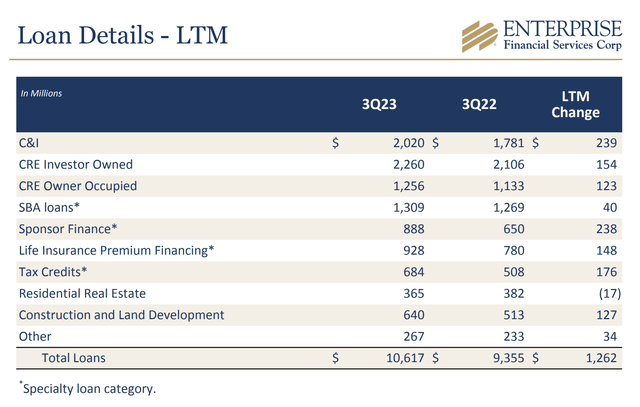

As deposits have grown, loans have followed suit. They grew from $7.22 billion in 2020 to $9.74 billion last year. By the end of the most recent quarter, they increased further to $10.62 billion. I do understand that one area that investors have been worried about when it comes to loans has been exposure to office properties. The good news for shareholders is that only $483.6 million, or 4.6%, of all loans on the company’s books involve office real estate. This says a lot when you consider that 33.1% of the company’s loan portfolio is in the form of commercial real estate. Another 19% involves commercial and industrial loans, while SBA loans come in third place at 12.3%.

Enterprise Financial Services

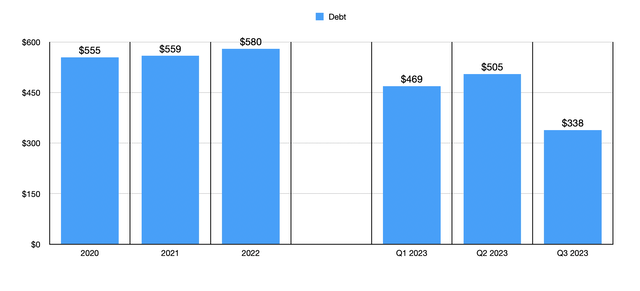

There are some other metrics that we should be paying attention to. For instance, from 2020 to 2022, the value of securities in the company’s portfolio expanded from $1.42 billion to $2.25 billion. That number has moderated since then and currently sits slightly lower at $2.22 billion. Cash, meanwhile, has been on the rise since the end of last year. At that time, cash and cash equivalents totaled $291.4 million. Today, that number is $370.7 million. What’s really impressive is that securities have remained elevated, loans have continued to grow, and cash has also continued to grow, all while debt has dropped. At the end of 2022, debt totaled $579.5 million. That number has since declined to $338.2 million today.

Author – SEC EDGAR Data

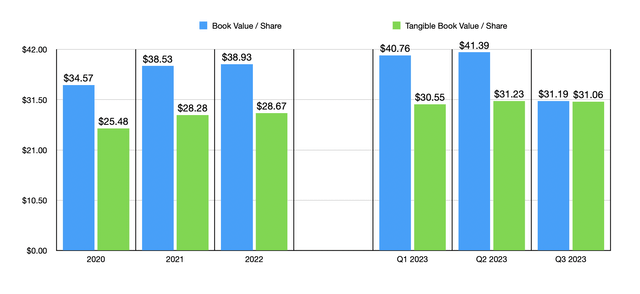

Another positive thing about the bank is that it has succeeded in gradually growing its book value per share. That growth has not always been linear. But the general trend is clear. In 2020, book value is $34.57 while tangible book value was $25.48. These numbers grew to $38.93 and $28.67, respectively, last year. And that trend of gradual growth has continued so far this year. As of the end of the third quarter, the book value per share of the company stood at $41.19. Meanwhile, the tangible book value was at $31.06.

Author – SEC EDGAR Data

When it comes to valuing a bank, there are two methods that I like to use. The first is price relative to book value. In this case, as of this writing, Enterprise Financial Services is trading at a 15.1% discount to its book value per share and at a 12.7% premium to its tangible book value per share. I’ve seen many banks both above and below both of these numbers. I would say that this is par for the course regarding what I have seen for much of this year.

The other way to look at the pictures is through the lens of earnings. Using last year’s results, the company is trading at a price to earnings multiple of 6.5. That’s quite a bit lower than what I have seen, but it’s not the lowest. The average in the space right now is around 10.4. So this does indicate some upside potential.

Takeaway

All things considered, I would say that Enterprise Financial Services makes for an interesting prospect. I don’t see any major red flags, to be perfectly honest. Debt is manageable, uninsured deposit exposure is within the range of what I like, deposits continue to grow at a nice clip, and that has allowed loans and securities to grow as well. Shares are attractively priced, and while the company has seen a bit of weakness on the bottom line in the most recent quarter, the overall trend will likely end up positive. When all of these things are added together, this makes me feel confident assigning the bank a ‘buy’ rating right now.